Claims processing operations had become increasingly complex and inefficient. The claim processing workflow involved multiple handoffs between various systems and users, which added to the complexity of the process.

The Insurance company faced significant challenges such as redoing the same process again, resulting in additional time and effort to rectify errors or address incomplete tasks, increased operating costs, and reduced productivity. These issues had a direct impact on customer satisfaction and overall operational efficiency.

Challenges

At a glance

Delays in processing and approving claims led to dissatisfied policyholders who experienced long waiting periods to receive their claim payouts. Slow turnaround times can result from manual processes, a lack of automation, inefficient workflows, or bottlenecks in the claims processing pipeline. These delays impact customer satisfaction and can harm the company's reputation.

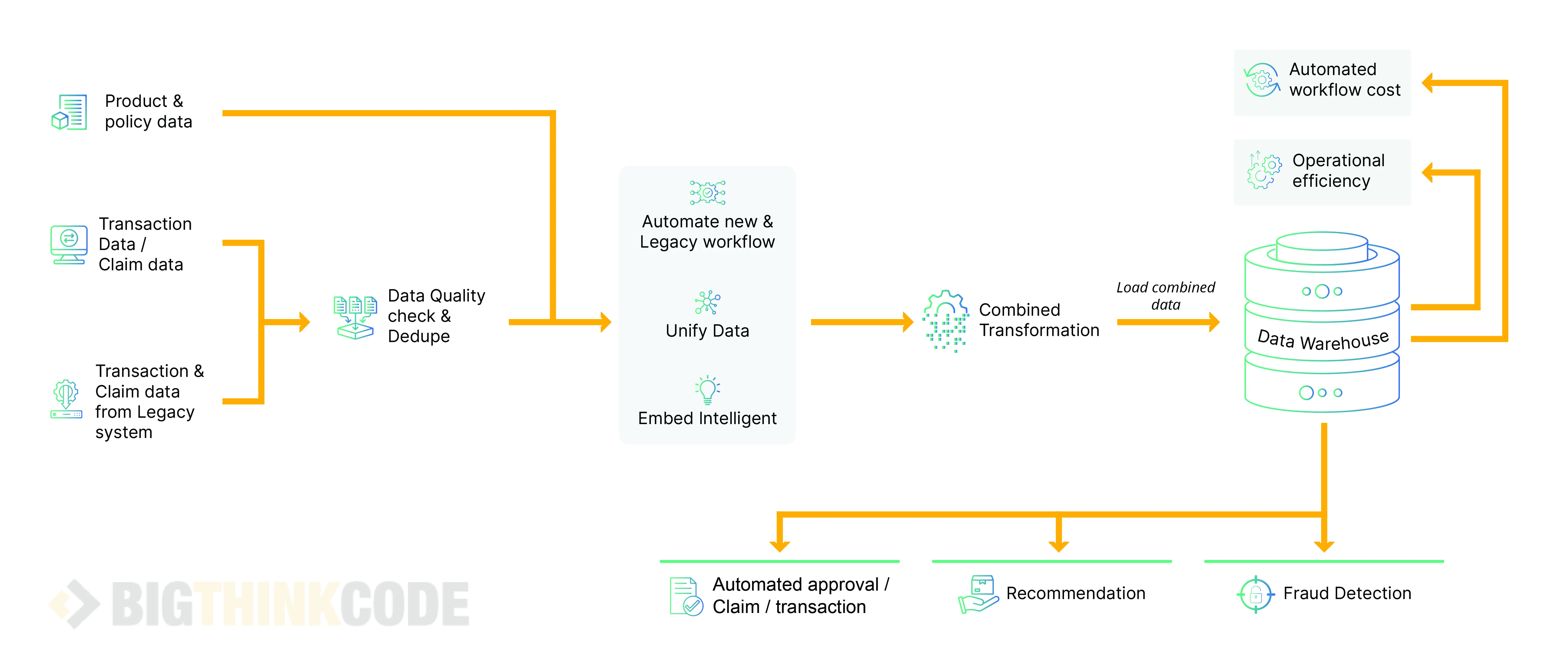

We begin by thoroughly understanding the existing claim management process, including its workflows, bottlenecks, pain points, and inefficiencies. Identified the areas that require improvement and gathering feedback from stakeholders, including claim handlers, policyholders, and other relevant parties.

Implement straight-through processing (STP) capabilities to enable seamless and automated claim handling, reducing the need for manual intervention and accelerating claim resolution. This includes automating data entry, adjudication, decision-making, communication, and payment processing.

Leverage appropriate technology solutions to automate and streamline various aspects of the claim management process. This may include implementing claims management software, workflow automation tools, document management systems, data integration platforms, and analytics solutions.

Benefits

Intelligent Document Processing like OCR & NLP

Workflow Automation

Rule-Based Decision Making

Data Driven Insights

Enhances Straight-through processing

Improved customer satisfaction

Conclusion

In a nutshell, a well-optimized claim management process is essential for insurance companies to deliver exceptional customer experiences, achieve operational efficiency, mitigate risks, and uphold their reputation in the market. By continuously improving and innovating their claim management practices, insurers can position themselves for success in an ever-evolving industry landscape.

Talk to us for more insights

What more? Your business success story is right next here. We're just a ping away. Let's get connected.